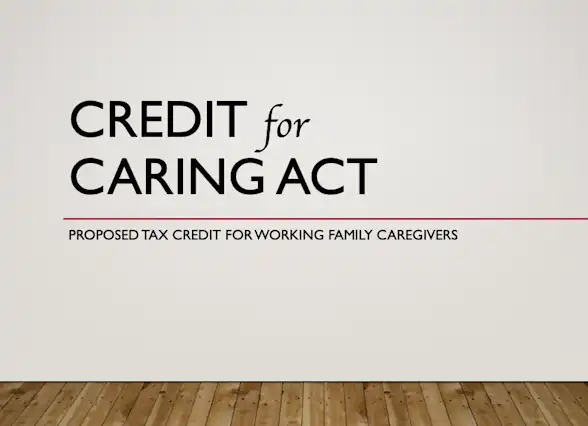

Can the Credit for Caring Act Help Me?

The Credit for Caring Act would provide a federal tax credit for eligible working family caregivers.

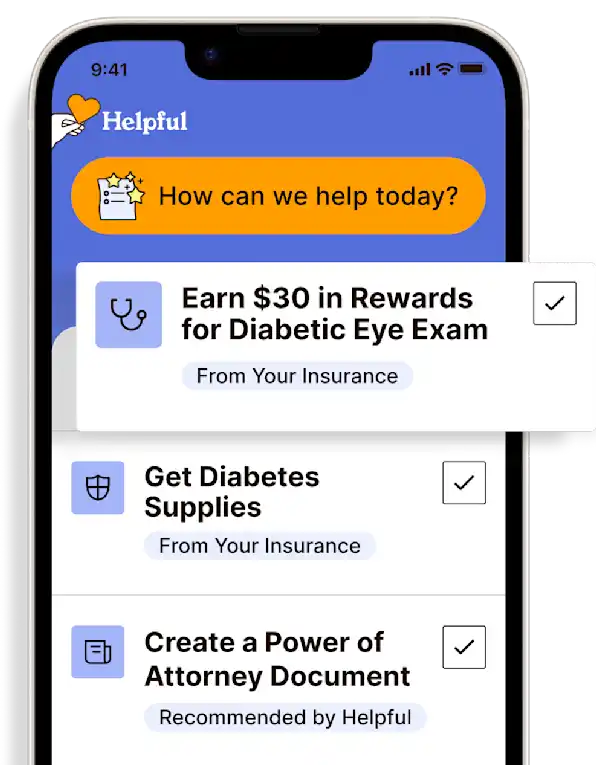

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Note that the Credit for Caring Act is legislation that has been reintroduced in Congress and has not yet been signed into law.

AARP has been working with legislators for 8 years on various versions of this bill.

If passed, it would support eligible individual caregivers with up to a $5,000 tax credit.

Write to your local and state legislators to support the bill.

Family caregiver spend

Families spend an average of $7,200 out of pocket caring for their loved ones (and that average exceeds $8,000 for those caring for persons with dementia), doing everything from making housing payments and utility payments, to making provider payments and assisting with medication costs, to paying for in-home care and running the household (shopping, errands, cleaning, and more), to installing home modifications and providing transportation, and much more.

Most family caregivers also have a part-time or full-time job, and almost half of them have reported negative financial impacts due to caregiving (quitting work, missing work, rearranging work hours, taking on debt, no longer saving).

Credit for Caring Act

On January 31, 2024, a bipartisan group of Senators and House Representatives reintroduced legislation to help qualified working family caregivers with a tax credit.

The Credit for Caring Act has been through several iterations over the past 8 years, and AARP leaders, who have worked with legislators on these various versions now believe the time is finally right for it to become law.

If passed, the Act would provide eligible individual caregivers with up to a $5,000 tax credit, that would cover 30% of qualified expenses incurred above $2,000. Expenses that the loved one pays toward their care do not count; only those incurred by the caregiver.

Family caregivers will need to meticulously document their out-of-pocket expenses above $2,000 to qualify for the credit - essentially a spreadsheet or ledger with attached receipts (and copies of any associated provider orders, when available).

Why is there a good chance it will get passed?

Caregiver support is now gaining serious momentum

Steps are being taken at both the state and federal levels to support caregivers, especially the executive order issued in April 2023

The aging population is growing every day, so the long-term crisis the country faces is now reaching critical mass

When the bill was reintroduced, more than 140 consumer organizations supported it

More members of Congress are family caregivers themselves and can relate

If passed, the law would go into effect for the 2024 tax year.

What can I do to help?

Write to your Senators and Representatives letting them know you support the bill.

RESOURCES

AARP - 2021 Caregiving Out-of-Pocket Costs Study

Lin-Fisher, B. (2023, February 5). Caregivers spend a whopping $7,200 out of pocket. New bill would provide tax relief. USA Today. Link

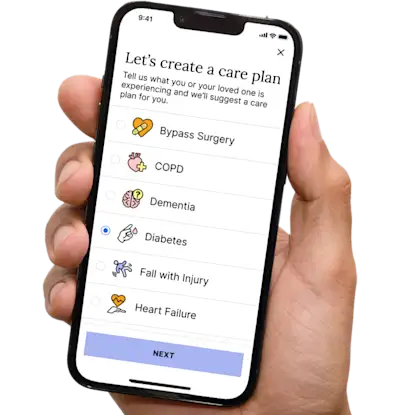

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private